Patricia Token White Paper

Restoring Trust, Ensuring Asset Recovery

This white paper is designed to offer our users a clear understanding of Patricia Token, its benefits and also answer possible questions our users have about the token. It covers token creation, distribution, mechanics, benefits, and transparency measures implemented by Patricia Technologies.

Token Creation and Naming

Background

Amidst the backdrop of a cyber attack that led to an unfortunate loss of assets, our commitment to integrity and customer trust spurred the creation of the Patricia Token. Serving not just as an internal currency, the token also epitomizes our commitment to transparency and restoring value to our users.

This white paper outlines the key features, benefits, and mechanics of Patricia Token, as well as addresses frequently asked questions to provide users with comprehensive insights into this compensation mechanism.

1. Introduction to Patricia Token

Patricia Token is a groundbreaking solution introduced by Patricia Technologies to address the aftermath of a security breach that led to the loss of user assets. Patricia Token has been developed specifically to serve as a debt management token.

It symbolizes a promise by Patricia Technologies to pay holders 1 USDT for each Patricia Token in the future, thereby ensuring asset recovery and addressing the impact of the security breach.

Patricia Token is not on-chain, it is an internal token used to represent debt and it would be managed by Patricia. The balance will mirror the dollar value of the converted assets.

2. Initial Distribution & Long Term View

Upon issuance, Patricia Tokens will be allocated to users as a debt instrument in exchange for the assets lost during the breach. This process establishes a tangible connection between users' losses and the compensation mechanism.

2.1 In essence, the Patricia Token that each user gets is a summation of the users’ BTC, NGN and USD assets.

2.2 Every other asset, e.g., ETH, XRP, DOGE, etc., is unaffected.

2.3 Users would be able to see the total amount available for withdrawal in their balances. Whatever Patricia tokens are in the available balance can be converted to USDT.

__2.4 _ _Customers who have filled out the Asset recovery form would be prioritized for withdrawals once the app relaunches.

2.5 On a month on month basis, more balances would be made available through the tokens.

2.6 Our vision is to formally launch the Patricia Token after we address our debt dynamics.

It will be made available as an active token once it serves its purpose as a debt management vehicle. We will then build on the trust that we accrue from repaying the assets to make a public launch of Patricia Token across external exchanges.

3. Scope of Conversion to Patricia Token

Conversion Mechanism

To ensure a seamless transition and consolidation of value and reopening of operations, the following conversion steps will be implemented:

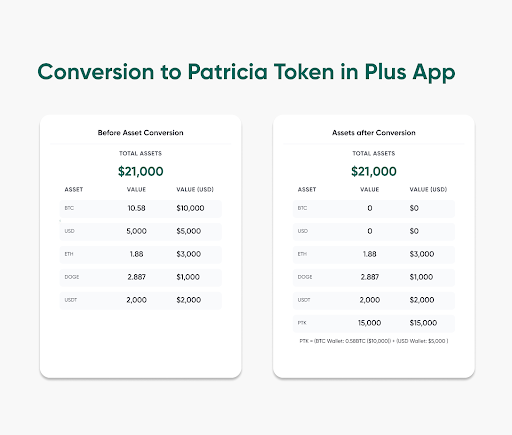

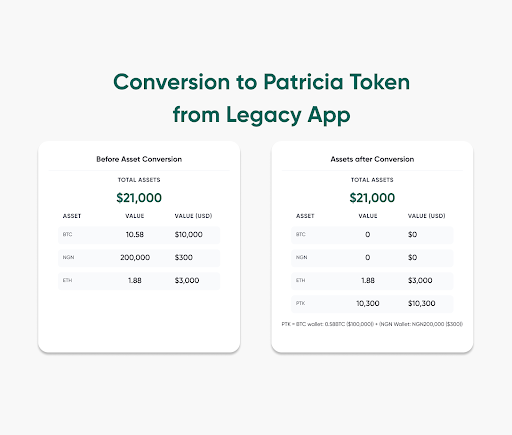

3.1 On Re-opening of the platform for business, Each user will be taken through an asset conversion process

3.2 Users' BTC and fiat assets (BTC, NGN and USD),if any, will be automatically converted to Patricia Tokens during the migration process.

3.3 The rate of conversion is based on the respective assets' USD value as of April 29th, 2023.

3.4 Pre-conversion, users will be informed about their assets' worth, and post-conversion, the equivalent Patricia Token amount will be highlighted.

3.5 Each user will have a dedicated Patricia Token wallet, displaying their converted assets' dollar equivalent.

3.6 Users will continue to have access to their other wallets like XRP, Doge, ETH normal

3.7 Users BTC, USD wallets will also be available for normal usage, post re-opening. The assets held in them prior to 29th April 2023 , would have been migrated to Patricia Token.

##$ 4. Vesting of Patricia Tokens

To ensure a controlled release of Patricia Tokens, a smart contract will be implemented. This contract will lock the tokens and gradually release them based on the exchange's profitability. This approach aligns users' compensation with the success of the platform, promoting transparency and trust.

Patricia Token Investing Mechanism

4.1 Upon accessing the platform, users are presented with an investment interface for their Patricia Tokens.

4.2 Initially, only Patricia Tokens are eligible for investment; however, integration of additional assets is currently under strategic review.

4.3 The system allows users the autonomy to designate the proportion of their Patricia Tokens they wish to commit to the investment.

4.4 Any Patricia Tokens not allocated to investment remain fluid and can be efficiently converted to USDT, thus facilitating subsequent trading activities.

5. Conversion To Patricia Token Explained

Your BTC and Fiat assets (Naira or US dollars) will be converted into the Patricia Token.

This means, your BTC and Fiat Balances will now be Zero while other wallets like ETH, USDT, DOGE etc will still remain the way they were before we stopped operations and will not be converted to Patricia Token .

Here are what you need to know about asset conversion

5.1 BTC and Fiat Assets (USD/Naira) are converted to Pat Token

Etherum, DOGE, USDT and other assets will not be converted

5.2 The Patricia TokenToken is dollar equivalent (1 Patricia Token = 1USD)

5.3 The dollar value of your BTC and Fiat assets will be equal to the dollar value of your Patricia TokenToken

5.4 Your BTC and Fiat wallet balances will automatically be zero when you login

5.6 Your uninvested Patricia Token will be available for you to converted to USDT

5.7 Only users who have filled and submitted the asset form will be allowed to trade from their available assets

PATRICIA PLUS APP

The Patricia Plus App has more coins than the Patricia Legacy App (Old App) which includes DOGE, XRP, USDT and Patricia Token.

The BTC and the USD assets on the Plus app will be converted to the Patricia Token while others assets like ETH, DOGE, XRP, USDT will not be converted. They will remain as they are.

PATRICIA LEGACY APP

The asset conversion on the old Patricia App is carried out by converting the BTC and Naira Assets to the Patricia Token leaving only the Ethereum asset untouched. The assets will be migrated to the new Patricia App where you will now be able to view your Patricia Token wallet and trade.

6. Patricia Token Valuation and Mechanisms

The creation of a redemption pool guarantees that the necessary liquidity is available to honor users' redemption requests and uphold the commitment to asset recovery.

Valuation Benchmark to USDT

The objective is to Ensure clarity and dependability in token valuation. Patricia Token (Patricia Token) is systematically aligned with the USDT's value. This 1:1 peg with the USDT, a leading industry stablecoin, guarantees stability in Patricia Token's valuation, removing uncertainties for token holders.

Contract Governance

We will automate Patricia Token release in line with exchange profitability. Patricia Tokens are governed by predefined contracts. The contract's algorithmic conditions release tokens based on the exchange's demonstrated profitability, ensuring a systematic, transparent, and reliable distribution method.

Ensuring Redemption Liquidity

We facilitate efficient token redemption and maintain user trust. We have established a redemption pool specifically for Patricia Token holders.

This mechanism ensures consistent liquidity, fulfilling user redemption requests in real-time.

The pool is a testament to our unwavering commitment to user asset recovery and the broader promise of the Patricia Token initiative. The structural design of the Patricia Token initiative is meticulously planned, drawing from both industry best practices and our proprietary insights, to ensure user trust and the seamless recovery of assets.

Benefits of Patricia Token

Asset Recovery

In the face of adversity and unexpected challenges like a cyber breach, the creation of the Patricia Token signifies resilience, adaptability, and an unwavering commitment to our users. The Patricia Token isn't merely a digital asset; it stands as a beacon of hope, symbolizing our determination to make things right.

By introducing the Patricia Token, we're taking a pivotal step towards reconciling with our community, ensuring that every user's compromised asset is recognized, accounted for, and on its destined path of restoration. It's our steadfast promise, set in the virtual stone of blockchain, that we're leaving no stone unturned in rectifying the past.

Stability

The cryptocurrency landscape is dynamic and often turbulent. While this brings opportunities, it also introduces uncertainties. Patricia Token offers a reassuring counterbalance to this inherent volatility. By maintaining a steadfast peg to the USDT, Patricia Token provides users with a basis of stability in the volatile crypto market. This ensures that users can hold Patricia Token with confidence, knowing that its value remains consistent and predictable, immune to the capricious winds of market fluctuations.

Access & Flexibility

Our platform's relaunch won't just be about restitution; it's about empowerment. The Patricia Token is engineered to offer users a seamless experience. When users are able to access their funds, the process will be straightforward, free from needless complications. Moreover, with the intuitive process that will help you convert Patricia Token to USDT.

They can choose to engage in trading, save the token and grow with it. It's not just about returning what was lost; it's about granting users the freedom to decide what comes next. Users have a clear path for withdrawals post-relaunch. Users gain priority access to withdrawals using Patricia Tokens once the platform relaunches, streamlining the process of accessing their compensated assets.

Trust

Patricia Token isn't just an instrument of compensation; it's a commitment to transparency. As we tread the path of recovery, our pledge is to keep our community informed every step of the way. Regular updates, unwavering clarity about our financial health, and open channels of communication are integral components of Patricia Token's ethos.

By embracing transparency, we aim to fortify the bond with our users, nurturing a relationship rooted in trust and mutual respect. Transparent updates about our financial standing is our commitment to our users.

Asset Recovery

Patricia Token seeks to cut through any complexity, offering users a clear and efficient route to reclaim and manage their digital assets. By streamlining the retrieval process, we're ensuring that every user finds it intuitive and hassle-free to navigate their way to asset recovery.

Patricia Token provides a clear path to recover assets lost during the security breach, reassuring users that their holdings are accounted for and steps are being taken to rectify the situation.

8. Redemption

Redemption Mechanism

Our Vision is to provide a seamless avenue for token holders to liquidate assets.

8.1 Patricia Token holders can directly redeem their unlocked tokens for USDT on our platform.__

8.2 A dedicated redemption pool has been established to facilitate these transactions. This pool is periodically replenished using the exchange's profits and fresh liquidity inputs.

8.3 By continually ensuring liquidity, we aim to provide uninterrupted, quick, and efficient redemption services to all users.

Trading Options

We want to offer users flexibility while maintaining the core function of the Patricia Token.

8.4 Patricia Tokento USDT conversion is the primary transaction allowed on the platform.

8.5 USDT, being a widely accepted stablecoin, offers users the ability to trade or convert into a myriad of other cryptocurrencies.

8.6 However, given the token's purpose as a compensatory tool, direct conversion of Patricia Tokentokens to fiat (USD or NGN) is restricted. This ensures that the token’s primary objective of compensation remains undiluted.

Secondary Market Dynamics

We want to Preserve the token’s stability and primary purpose.

8.7 Patricia Tokens will remain excluded from open market trades till we are ready to launch it formally.

8.8 Entities such as Bitfinex and Kucoin issued compensatory tokens post security breaches. These tokens, when shielded from the secondary market, maintained stable valuation and met their compensation objectives efficiently.

8.9 Restricting secondary market access ensures that the token's value remains stable, in alignment with its peg to the USDT, and serves its primary compensatory function effectively.

8.10 In summary, the Patricia Token system is designed to ensure effective asset recovery and maintain stability. With efficient redemption processes, flexible trading options, and a protective approach to market dynamics, we stand committed to user compensation and trust rebuilding.

9. Historical Precedence

Tokens as compensation have historical roots. Renowned platforms like Bitfinex, DAO Maker, Kucoin, Upbit, and Gate.io have previously implemented similar strategies. We are summarizing some historical precedence below:

BITFINEX CASE STUDY

Year of incidence - 2016

Summary of Incidence

Bitfinex, one of the largest cryptocurrency exchanges globally, experienced a severe hack in 2016, with the hackers stealing 119,754 Bitcoin1.

The hack was meticulously planned and executed over several weeks, with the hackers raising the daily withdrawal limit and using the private keys to transfer Bitfinex's Bitcoins to addresses they controlled. Around 2,000 approved transactions were sent to a single wallet from users' segregated wallets.

Immediately thereafter, Bitcoin's trading price plunged by 20%, causing the value of the stolen Bitcoin to dip to US$58 million. After learning of the breach, Bitfinex halted all Bitcoin withdrawals and trading and said it was tracking down the hack.

Exchange customers, even those whose accounts had not been broken into, had their account balance reduced by 36% and received BFX tokens in proportion to their losses.

Token Issued - BFX

Protocols for the token issue

Rate: 1 BFX - 1 USD

Total BFX supply: 216,525,879.00

Process of Settlement

Buying back BFX tokens from holders to improve trust. Bitfinex bought back the first 1.1% of the tokens issued to users to promote the trust its community has in the exchange.

Reduction of the Bitfinex reserve to service debt/buy back issued tokens. The exchange withdrew money from its reserves to service debts by using the withdrew funds to buy back BFX from users.

Trading BFX with USD and other assets available openly. Unlike other exchanges with similar problems, Bitfinex made trading of the debt token available to users.

Every BFX token was destroyed after creditors were settled. To ensure that no user is left behind, all issued BFX were bought back and destroyed after the deadline for recovering them elapsed.

Final Verdict

Debt settled 100%.

Dragon Ex Case Study

Year of Incidence - 2016

Summary of Incidence

The Singapore-based cryptocurrency exchange DragonEx announced on its official Telegram channel that it was hacked on March 24, 2020. The users’ and exchange’s crypto assets were transferred and stolen. The judicial administration of Estonia, Thailand, Singapore, and Hong Kong were informed.

DragonEx’s Telegram admin provided wallet addresses for 20 cryptocurrencies to which the stolen funds had apparently been transferred. The list included the top-five cryptos by market capitalization: bitcoin (BTC), Ether (ETH), Ripple (XRP), Litecoin (LTC), and EOS, as well as Tether stablecoin (USDT). The exchange issued a 7 million USDT value of Dragon Bond (DB) which is 1:1 with USDT.

The stolen user assets were calculated at the price when it was hacked, and DragonEx compensated 10% of the stolen assets as original currencies and the other 90% were compensated with DT.

Token Issued

Dragon Token (DT)

Protocols for the token issue

- Rate: 1 DT - 0.059996 USD

- 1 DT - 9.8USDT (Allegedly)

- Total DT supply: Unavailable

Process of Settlement

100% of DragonEx's transaction fee income sharing with DT holders: The exchange shares with every holder of DT, percentage of income generated from transaction fees done on the exchange. This helps the exchange remain trusted by users.

-

Holders get voting rights in the Dragonland community: Aside from income sharing, holding DT gives users the right to direct the direction of the exchange as they can vote on events and ventures of the exchange.

-

Users who refer people to mine DT get 20% of the mining fee: To drive up adoption of DT, DragonEx created referral bonuses for users who refer other people to mine DT.

-

Usage of DT as currency in Dragonland: DT is adopted as DragonEx’s virtual world currency to improve adoption and promote use cases.

-

Final Verdict - Debt recoevery still in progress

CoinFLEX Case Study

Year of Incidence- 2022

Summary of Incidence

CoinFlex said a counterparty owed the exchange $47 million and it was forced to halt withdrawals. CEO Mark Lamb identified the counterparty as Roger Ver, former CEO of wallet provider Bitcoin.com, and said he has been issued a notice of default.

After calculating the investor’s final “significant” losses in the exchange’s FLEX token, the total owed by the investor has now nearly doubled, co-founders Sudhu Arumugam and Mark Lamb wrote.

Token Issued - rvUSD

Protocols for the token issue

- Rate: 1 rvUSD - 1 USD

- Total rvUSD Supply: 83,652,972.89

Process of settlement

Token is issued as evidence of debt Users receive rvUSD which serves as debt that the exchange owes users.

Giving creditors and team members 65% and 15% of the company respectively Users and team members of the exchange are given percentages of the company.

Token had no use case aside from debt representation

Holders had no right to sue the exchange By accepting the token, users waive the rights to sue the exchange.

Final Verdict

- Debt repayment is still in progress

10. FAQs & Key Notices

10.1.1 What is Patricia Token?

Ans: The Patricia Token is an internal token that serves as a debt management token for affected assets lost during the exposure we suffered. Its value does not fluctuate, rise, or fall; its value is pegged against the USDT and would be backed by USDT.

10.1.2 Why Patricia Token?

Ans: We were victims of a Hack, and assets were lost, which included some customers' funds. Patricia Token is a Debt Instrument that ensures that all Customers' assets remain accounted for and initiates the road to asset recovery.

10.1.3 Is Patricia Token influenced by the general market (dollar) rate?

Ans: The Patricia Token is pegged to a stable coin, the USDT. Currently, it will only be available to customers who have completed the asset validation process.

10.1.4 Can I withdraw my Patricia Token for Naira?

Ans: Your Patricia tokens can only be converted to USDT, which you can immediately convert to USDT on-chain. Like any other coin, you can decide to trade your USDT for Naira, BTC etc..

10.1.5 Which of my assets are converted to Patricia Token?

Ans: All affected assets from the previously announced hack are those that were pegged to the Patricia token (BTC, USD, and Naira). These assets will be converted to Patricia Token at their respective trading rates as on 29th April 2023. Every other asset, e.g., ETH, XRP, DOGE, etc., is unaffected. (Click the link in the bio to read more.)

10.1.6 When Can I Make Use of Patricia Tokens?

Ans: Users would be able to see the total amount available for withdrawal in their balances. Whatever Patricia tokens are in the available balance can be converted to USDT. Customers who have filled out the Asset recovery form would be prioritized for withdrawals once the app relaunches. On a month on month or quarterly basis, more balances would be made available through the tokens. (Click the link in bio to fill the asset form)

10.1.7 What happens to the other assets?

Ans: Other assets like Eth, DOGE, XRP, USDT, etc. will NOT BE CONVERTED to Patricia tokens; they will be available for use on your App once we relaunch.

10.1.8 Were customers informed about Patricia Token?

Ans: Since informing the public of the Cyber breach, we’ve been in constant communication with our customers and stakeholders. Over the past two months, we have had town halls and created focus groups with customers. The last two town halls were held on June 9 & August 10, respectively.

10.1.9 Are we the first to do this?

Ans: It is quite common Practise in the Crypto community, For companies to issue tokens to compensate for losses, BItfinex issued BFX tokens, DAO Maker Issued DAO Tokens, Kucoin issued KCS tokens, Upbit, Gate.io all did same

10.1.10 Will subsequent Crypto assets be converted to Patricia tokens?

Ans: No, subsequent Crypto assets will not be converted to Patricia tokens.

10.1.11 What happens if I keep my Patricia Token in my wallet?

Ans: Your Patricia Token can only be kept in your Patricia Token wallet, and the value is still pegged to USDT at a 1:1 rate.

10.1.12 Will the Patricia Token ever get to zero?

Ans: No, the Patricia Token can never be equal to zero, we would be backing up every Patricia Token with USDT.

10.1.13 How is Patricia Token managed?

Ans: Patricia Token is not on-chain, it is an internal token used to represent debt and it would be managed by Patricia. The balance will mirror the dollar value of the converted assets.

10.1.14 Can I purchase Patricia Token with other assets?

Ans: No, Patricia Token, cannot be bought, it is a debt instrument. Used to hold the Debt Patricia we owes customers. For now, it is only issued to customers with affected balances, it cannot be bought with other assets.

10.1.15 What can I do with my Patricia Token?

Ans: You can trade your available Patricia Token for USDT and you can do anything the system allows with USDT. You can convert your Patricia token to USDT. You can use your stable coin however you chose. You can sell, withdraw or spend for Fiat.

10.1.16 What differentiates available balance and book balance?

Ans: The book balance is the total of converted crypto assets that is owed to you by Patricia. Available Balance is the total Patricia Token users have available to use instantly.

10.1.17 What rate is used to convert my BTC and Naira to Patricia Token?

Ans: The USD rate of BTC and Naira on 29th of April, 2023.

At the time of the initial announcements was made.

See More sample information Below.

10.1.18 How can I have access to my Patricia Token wallet?

Ans: Users would be able to access their Patricia Tokens, when we relaunch.

10.1.19 How is the available balance determined? What is the basis or percentage?

Ans: The available balance determination in a financial system can be influenced by the type of assets held. For most assets, the available balance remains straightforward and is equal to the total balance. However, for selected assets like BTC, Naira, and USD, there's a nuanced approach. These assets are converted into Patricia Tokens.

The availability of Patricia Tokens varies based on individual user portfolios and is also influenced by the liquidity present within Patricia. We recognize that such complexities might raise questions, and in our commitment to uphold transparency, we continuously update users about the liquidity status and any other factors that might influence their available balance.

Our aim is to ensure users are always informed and confident in their financial decisions with Patricia.

10.1.20 Can I opt out of converting my assets to Patricia token?

Certainly. Only assets in BTC, Naira, and USD are automatically converted to Patricia Tokens. For all other assets, there's no conversion to Patricia Tokens. Once converted, all of you available Patricia Tokens can be readily changed to USDT, which can then be swapped or converted to your desired fiat currency, ensuring flexibility and ease in your transactions.

10.1.21 What is the timeline for retrieving the full value of Patricia tokens and converting my assets to cash?

We are diligently working to ensure a seamless retrieval process for Patricia tokens. While we cannot provide a definitive timeline currently, rest assured, our priority is to keep you informed and updated every step of the way. Your trust and patience are highly valued.

11. Learning our Lessons

In our steadfast commitment to safeguarding user assets, we've embarked on a comprehensive security enhancement initiative. Key measures include the deployment of advanced multi-layered security protocols, strategic segregation of assets, regularized security audits, and rigorous penetration testing. Our collaboration with top-tier infrastructure firms, especially Deimos, further strengthens our defenses, exemplifying our dedication to a fortified trading environment.

Security Revamp overview

Advanced Security Protocols:

Implemented state-of-the-art, multi-layered security systems to defend against varied cyber threats. Integrated advanced multi-layered security protocols, ensuring data encryption at every transaction level, thereby mitigating the risk of breaches and unauthorized access.

Wallet Infrastructure Upgrade:

Adopted a rigorous approach in segregating assets between cold and hot wallets, minimizing exposure to external threats. Increased the proportion of assets stored in cold wallets, minimizing the potential damage from any online security breaches. Regular audits ensure hot wallets maintain only essential operational amounts

Routine Security Audits:

Established a schedule for periodic security audits, ensuring that our systems adhere to the latest security benchmarks.

Penetration Testing:

Collaborated with specialized firms to routinely test our defenses, simulating real-world attacks to identify and rectify potential vulnerabilities.

Deimos Partnership:

Partnered with Deimos, a renowned infrastructure company, to holistically review and enhance our security infrastructure, providing additional layers of protection and resilience.

Advanced Threat Intelligence and Monitoring:

Adopted real-time threat intelligence tools that monitor and analyze transaction patterns. Any anomalous activity triggers instant alerts, ensuring rapid response to potential security threats. We are in the process of implementing a Transaction Level Monitoring system and implementing a KYT (Know Your Transaction) Protocol to enhance our Security posture.

Patricia's Secure Asset Fund for Users (SAFU) Initiative

At Patricia, the security and transparency of user assets take the center stage. Understanding the vitality of these concepts, especially in the rapidly evolving cryptocurrency landscape, Patricia is proud to unveil its SAFU Initiative. The Patricia SAFU initiative incorporates robust measures to foster transparency, ensure liquidity, and safeguard assets.

Transparency and Trust

Visible SAFU Wallet in Patricia Plus Apps:

Patricia goes the extra mile in promoting transparency. Users can now view the funds in the SAFU wallet directly from their Patricia Plus apps. This feature is designed to foster a deeper sense of community and keep our users informed.

Quarterly Financial Reports:

To reinforce its commitment to openness, Patricia will publish a quarterly statement of account for the fiat wallets. This report will be disseminated through our prominent marketing channels, ensuring our users are always in the know.

Investment Returns and Capital Protection

Patricia Token ROI: Users who choose to invest their Patricia Token can rest assured. Both capital and ROI of such investments will be sourced from the SAFU funds, underscoring Patricia's commitment to ensuring profitable and safe investments.

Security First

Hard Wallet Storage: Patricia ensures that assets comprising SAFU are stored in hard wallets, providing an added layer of security. These wallet addresses are transparently shared, allowing both current users and potential customers to view them with ease.

__Fiat Storage in Dollar Account: __

In addition to cryptocurrencies, Patricia also uses a Dollar account to store fiat funds integral to SAFU, ensuring diversified and safe storage.

Liquidity Assurance

Quarterly Investment Releases: Patricia recognizes the importance of liquidity. Thus, users desiring to withdraw their investments from SAFU can do so once every quarter. This systematic approach is instituted to maintain a steady liquidity stream.

Diverse Liquidity Sources: SAFU funds are derived from a multi-faceted approach:

- A percentage of every transaction fee on the Plus App.

- Returns on investments Patricia makes in intriguing ventures or businesses.

- A portion of investments secured from Venture Capitals.

- A significant 20% of Patricia's quarterly profits

Secured Fund Disbursement

In the unlikely event of a breach or a significant loss that Patricia might struggle to recover due to erratic market movements, users can have peace of mind. They will have the option to retrieve either all or a portion of their funds from SAFU, a testament to Patricia's commitment to its user base.

Unyielding Emphasis on Security

Hard Wallet Configuration: While transparency is paramount, the security of the funds within SAFU is non-negotiable. Patricia employs hard wallets that are autonomous from its network. This ensures a further protective layer, shielding assets from potential vulnerabilities.

Restricted Wallet Access: Access to these wallets is rigorously monitored and restricted, ensuring that the funds are not only transparent but also safeguarded against unauthorized access.

In conclusion, Patricia's SAFU initiative stands as a beacon of trust, transparency, and security in the cryptocurrency landscape. Users can confidently navigate their financial journeys, knowing they are backed by a robust safety net.

Increasing Liquidity in ecosystem

We are currently engaged in ongoing discussions with Paxos regarding the forthcoming launch of the Patricia Token, which will be backed by the U.S. dollar.

In essence, Paxos assumes responsibility for all aspects of custody, minting, and reserves akin to tokens such as BUSD. Notably, Paxos possesses licenses from the New York City Department of Financial Services and other reserve licenses that many other stablecoin issuers do not possess.

As previously indicated, we intend to leverage their established infrastructure to potentially facilitate the issuance and minting of the Patricia Token stablecoin.

12. Maintaining Transparency and Trust

Regular Updates

To foster trust, Patricia Technologies commits to providing regular, transparent updates on the exchange's financial health and profitability. This approach ensures users are well-informed about the platform's progress.

Financial Auditing

To enhance transparency, a transparent mechanism for auditing the exchange's finances and profits will be established, enabling users to verify the accuracy of the vesting mechanism.

13. Conclusion

Rebuilding Trust

The introduction of Patricia Token underscores Patricia Technologies' commitment to rebuilding trust with users after the security breach, addressing losses, and providing a transparent and innovative solution.

Coming Back Strong

We view adversity as an opportunity to prove our commitment. Patricia Token is not only our solution but also our promise. We are devoted to ensuring every user's asset is accounted for, and the road to asset recovery is streamlined. Our unwavering focus is on restoring trust, and we appreciate the continued support from our stakeholders and customers during these challenging times.